Python for finance investment fundamentals & data analytics – Python for finance investment fundamentals and data analytics opens the door to a transformative journey, empowering you with the tools and techniques to navigate the complex world of financial analysis. This comprehensive guide delves into the intricacies of Python libraries, data preprocessing, risk and return analysis, machine learning, and data visualization, providing a solid foundation for making informed investment decisions.

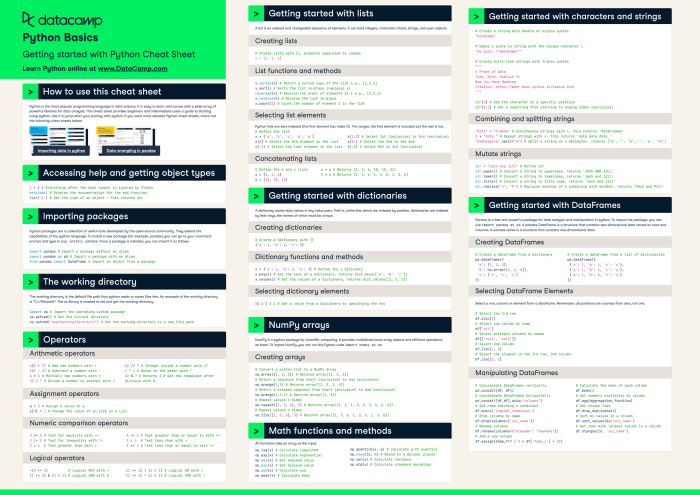

As we embark on this exploration, we will uncover the secrets of Python’s powerful libraries, NumPy, Pandas, and SciPy, and their applications in financial data manipulation, numerical operations, and statistical analysis. We will delve into the art of data preprocessing, mastering techniques for data cleaning, handling missing values, and feature engineering.

This will lay the groundwork for insightful data exploration and visualization, using Python to create histograms, scatterplots, and time series plots that reveal hidden patterns and trends.

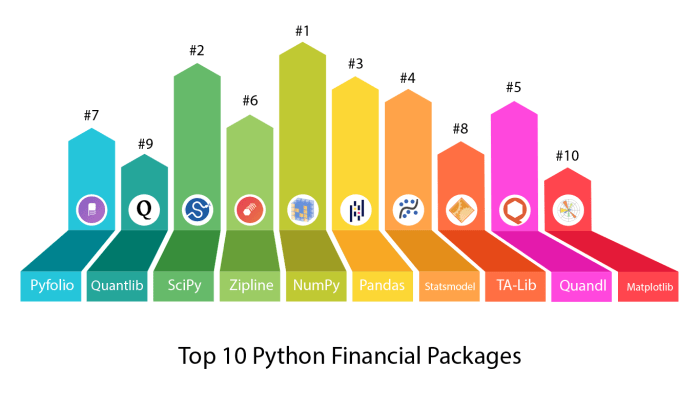

Python Libraries for Finance Investment Fundamentals

Python offers a comprehensive ecosystem of libraries specifically designed for financial data analysis and investment fundamentals. These libraries provide powerful tools for data manipulation, numerical operations, and statistical analysis, making them essential for professionals in the finance industry.

NumPy:NumPy (Numerical Python) is a fundamental library for scientific computing in Python. It provides a powerful N-dimensional array object and useful linear algebra, Fourier transform, and random number capabilities. NumPy is widely used for data manipulation, matrix operations, and numerical computations in finance.

Pandas:Pandas is a library built on top of NumPy that provides data structures and data analysis tools for working with structured data. It offers dataframes, a tabular data structure, and various functions for data manipulation, cleaning, and analysis. Pandas is extensively used for financial data analysis, time series analysis, and data exploration.

SciPy:SciPy (Scientific Python) is a collection of modules for scientific and technical computing. It includes functions for optimization, integration, linear algebra, statistics, and more. SciPy is commonly used in finance for risk analysis, portfolio optimization, and hypothesis testing.

Data Preprocessing and Exploration

Data preprocessing is crucial in financial investment analysis as it ensures the data is clean, consistent, and ready for analysis. Common preprocessing tasks include:

- Data Cleaning:Removing duplicate data, handling missing values, and correcting errors.

- Feature Engineering:Creating new features from existing ones to enhance the data’s predictive power.

- Normalization:Scaling data to a common range to facilitate comparisons and improve model performance.

Python offers various libraries for data exploration and visualization, such as Matplotlib and Seaborn. These libraries enable the creation of histograms, scatterplots, time series plots, and other visualizations to explore the data, identify patterns, and gain insights.

Risk and Return Analysis

Risk and return are key concepts in financial investments. Python provides tools for calculating risk measures, such as:

- Volatility:Standard deviation of returns, a measure of price fluctuations.

- Standard Deviation:A statistical measure of the dispersion of data around the mean.

- Value at Risk (VaR):A statistical measure of the potential loss in a portfolio over a given time period.

Python also supports portfolio optimization techniques, such as:

- Diversification:Combining different assets to reduce overall portfolio risk.

- Risk-Adjusted Performance Evaluation:Assessing portfolio performance relative to its risk level using measures like the Sharpe ratio.

Machine Learning and Predictive Modeling

Machine learning algorithms are increasingly used in financial investment analysis for tasks such as:

- Stock Price Prediction:Forecasting future stock prices based on historical data and market conditions.

- Fraud Detection:Identifying fraudulent transactions or activities.

- Portfolio Management:Optimizing portfolio allocation and risk management.

Python offers a wide range of machine learning libraries, including scikit-learn, TensorFlow, and PyTorch. These libraries provide algorithms for supervised and unsupervised learning, enabling analysts to build predictive models and gain insights from financial data.

Financial Data Visualization: Python For Finance Investment Fundamentals & Data Analytics

Data visualization is essential for communicating financial insights effectively. Python libraries like Matplotlib and Seaborn provide tools for creating:

- Candlestick Charts:Visualizing price movements of stocks or other financial instruments.

- Bar Charts:Comparing different financial metrics or categories.

- Line Charts:Displaying trends and patterns over time.

Interactive visualizations allow analysts to explore data, identify anomalies, and make informed decisions.

Frequently Asked Questions

What are the key Python libraries used in finance?

NumPy, Pandas, and SciPy are the foundational Python libraries for financial data analysis and investment fundamentals.

How can I use Python for data preprocessing in financial analysis?

Python offers a range of techniques for data cleaning, handling missing values, and feature engineering, enabling you to prepare your data for meaningful analysis.

What are the applications of machine learning in financial investment analysis?

Machine learning algorithms can be applied to tasks such as stock price prediction, fraud detection, and portfolio management, enhancing the accuracy and efficiency of investment decisions.